The Iowa New Jobs Training Program (260E) is an incentive program for companies expanding or relocating to a new facility in the state of Iowa. Participation in the program allows employers to be reimbursed for a portion of training expense and wages for new jobs created in the state.

The 260E program is one of the easiest and most beneficial incentive programs from the state of Iowa. The community colleges across the state administer the program and over 300 companies in Kirkwood’s seven county region have participated in the program.

Eligible industries: manufacturing, processing, assembling products, warehousing, wholesaling, or conducting research and development as well as businesses engaged in the provision of services that have customers outside of Iowa.

Iowa New Jobs Training Program (260E) (Kirkwood Community College)

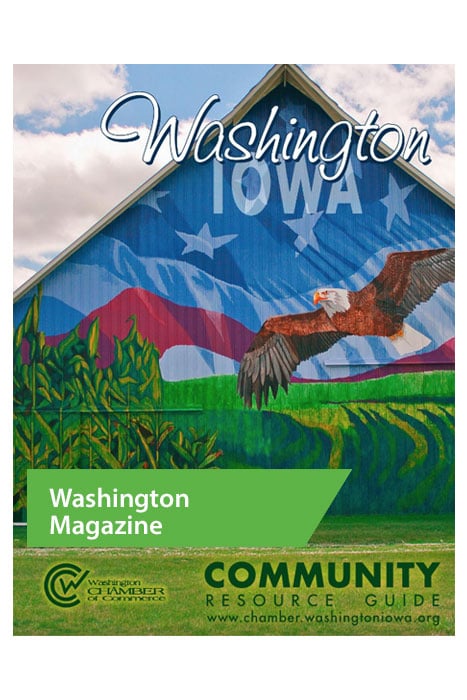

Washington Chamber of Commerce

Washington Chamber of Commerce WEDG

WEDG City of Washington

City of Washington